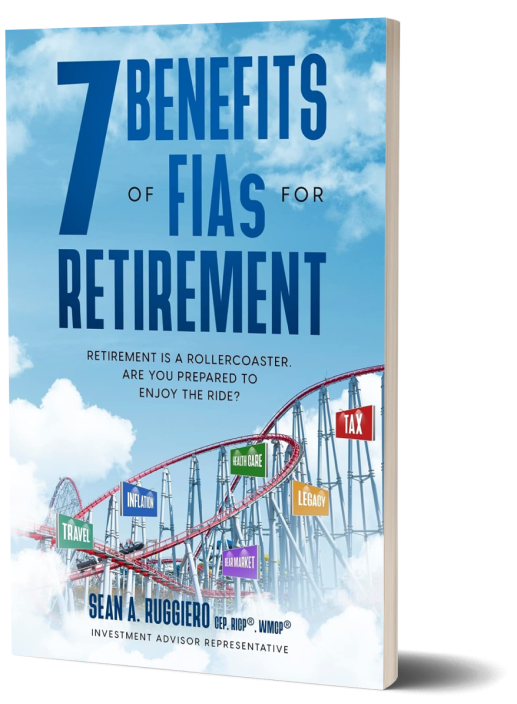

Today’s Americans are facing more retirement challenges than they have in the past 80 years. The decline of pensions, low bond yields, longer lifespans, restrictions in Social Security, inflation, cost of long-term care, rising health care costs, market volatility, and pandemic disease have all combined to create seemingly insurmountable retirement challenges for many Americans today.

If you were boarding an airplane and the pilot announced over the intercom, “Folks, we have a 22% chance of going down in a fiery ball of flames today,” would you stay in your seat or would you get up and walk off the plane? Chances are, you would find your way to the nearest exit and never travel on a plane again. Where am I drawing this comparison from? Since 1950, the S&P 500 has gone down 22.8% of the time (16 out of 70) years. Those who know me know that I am a patriot and a capitalist, and I believe in the U.S. stock market, so I am not citing these statistics to evoke fear in the reader. I am citing them because when it comes to your retirement, any down market can result in a drastic change for the worse in your lifestyle.

Unfortunately, people tend to do the opposite of what is ideal (remember, we are largely savers, not investors). When the market is climbing, we tend to not want to sell because we get greedy and we are afraid of missing out on more gains. Conversely, when the market starts to slide, we panic and sell too early. These are emotional reactions, and they are completely avoided when your funds are in an FIA.